Distributed Ledger Technology / Blockchain

Overview

Using the flexibility resources potentially provided by consumers and/or prosumers may enable network constraints to be met [1]. Consumers or prosumers are given an active, remunerated role in grid-balancing, whereas the aggregator is remunerated to stabilise the electricity system. The main issue is then securing such transactions. One solution may be the distributed ledger technology, which includes the blockchain option: both options support bidirectional information flows between different nodes in the energy systems while streamlining transactions [2].

A distributed ledger is a record of consensus using a cryptographic audit trail, which is maintained and validated by participating nodes. This cryptographically assured and synchronised data can be spread across multiple institutions. Distributed ledgers can be either decentralised, granting equal rights within the protocol to all participants, or centralised, pinpointing the rights of specific participants.

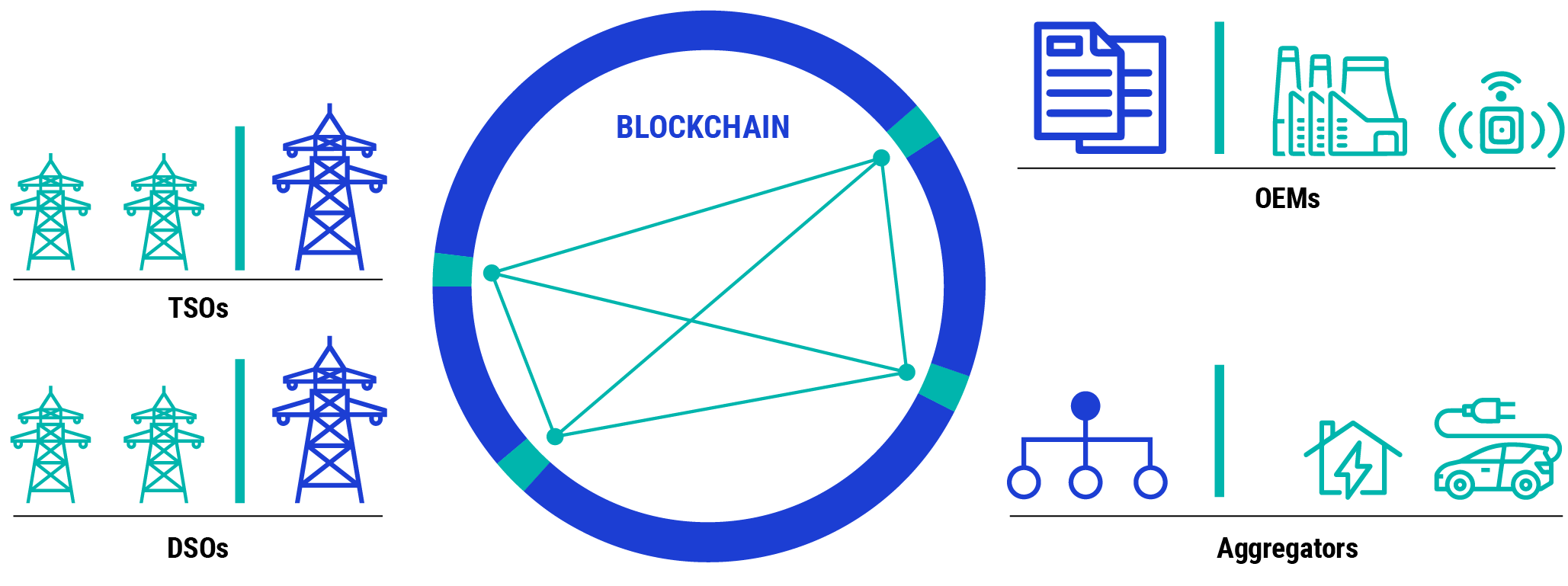

A blockchain is a specific method of implementing a distributed ledger: not all distributed ledgers necessarily employ blockchains. As depicted in the schematics below, blockchain is a distributed and immutable ledger of transactions without the need for central governance and trusted third parties. So far, only the blockchain approach has been deployed in operational applications in the energy sector.

Application fields:

- Grid management and control;

- Grid asset management;

- Blockchain-enabled energy trading;

- Cross-border power system data exchange;

- Integration of demand response to serve ancillary services; and

- Enhancement of residential demand response.

Challenges in reaching the scope:

- Need for a predetermined protocol for a distributed network to reach consensus on including a transaction, handling some pieces of data and transferring the ownership;

- Difficulty, cost and validation time of the prototype algorithms; and

- Algorithms’ dependence on the blockchain design.

Benefits

The table below [2] lists the potential applications using blockchain:

| Market Issues | Tentative impacts of Blockchain |

|---|---|

| Efficient large scale RES integration | Efficient, automated and decentralised grid management and control: blockchains can be used to improve the balance of supply and demand, automated verification of grid connections, the settlement of renewable energy usage, and ensure better coordination between Transmission System Operator (TSO) & Distribution System Operator (DSO). |

| Increased coordination between System Operators (SOs) | Improved asset management: blockchains can facilitate decentralised grid asset management and control, enabling real-time monitoring of supply in demand response (DR) activity to maintain grid reliability. |

| Integrating Demand Response to serve Ancillary Services | Design smart contracts to engage and reward willing customers to help in DR activity to maintain the grid more economically. Blockchain can help markets for demand response remain independent and unlock a variety of dispersed assets for participation. |

| Promote more residential demand response | Due to the data integrity and traceability provided by blockchain technology, the design of markets is better-informed and more transparent. This leads to better pricing for consumers and opens up the potential for incentivising behavioural change and DR. |

| Efficient cross-border power system data exchange | Cross-border data exchange incurs costs as data flows through multiple intermediaries, leading to delays in decision making and potential loss of data. Blockchain can streamline the process by removing delays and ensuring data integrity, as data are not transferred but immutably recorded. |

Table: Potential applications of blockchain.

EU and national relevant regulations:

- The Clean Energy Package published in 2019 allows for new organisational options for trading electricity and thus increases the power system flexibility: involving myriads of single consumers and prosumers via aggregators.

- Agency for the Cooperation of Energy Regulators (ACER) published the EU regulation 2019/943 on 5 June 2019 with a direct binding legal force as of 1 January 2020 in all member states of EU 27 [3].

- Public consultations by ACER on a network code for demand response based on a draft proposal built by ENTSO-e and EDSO [4].

Current Enablers

The enablers of blockchain are listed below:

- Information and Communication Technology (ICT) infrastructure: existing ICT infrastructures such as smart metering networks and broadband networks are adequate for the smooth operation of crowd balancing platform(s). Current peer-to-peer (P2P) protocols based on IEEE Standard 1547.3-2007 give adequate results [5]. Cybersecurity issues remain an issue [6]. The convergence of the Internet of Things (IoT), Artificial Intelligence (AI) and blockchain will revolutionise power markets, helping to enable seamless connectivity, automation and secure data sharing in complex power networks management [7].

Crowd balancing platforms: coordinators between network operators (transmission and distribution) and “crowding” clients use a Crowd balancing platforms which:

- Assist TSOs in receiving flexibility offers and settling financially with balance service providers, individual network users and aggregators who have signed a balancing service agreement with TSOs, and Balance Responsible Parties (imbalance);

- Are also able to activate and deactivate such offers; and

- Handle measurement data and validate the delivery of energy.

Some drawbacks of the blockchain process must be circumvented, such as:

- Scalability; and

- High energy consumption.

R&D Needs

R&D mainly focuses on:

- Market schemes: implementation in serving ancillary services such as voltage support, frequency response, peak shaving;

- Large scale network trading and simulation: trading algorithms need to be simulated for the large-scale realistic power system model to observe the impact of computational complexity on the conduct of trading in such a large system [8]; and

- Relationships between retail/wholesale and P2P energy markets: The P2P energy market is considered as a ‘‘price taker”. Future work may need to consider the P2P energy markets as ‘‘price makers”, and thus their relationship with retail/wholesale should be reconsidered.

The technology is in line with milestones “Integration of peer-to-peer, local, wholesale and ancillary services markets in daily operations” and “AI and ML solutions to boost horizontal and vertical system integration” under Mission 5 of the ENTSO-E RDI Roadmap 2024-2034.

TSO Applications

Examples

| Location: Nord Pool | Year: 2023 |

|---|---|

| Description: The FlexiSwitch project will provide flexibility service providers with a new standard interface that enables direct access to balancing and wholesale energy markets. The stakeholders will be able to trade easily and have the choice of where to place their flexibility – between ancillary services markets, managed by TSOs and the intraday market. The project is positioned as an open infrastructure to facilitate the market in a neutral manner, with the possibility of being extended. | |

| Design: Flexibility will be routed to the Nord Pool’s intraday market and to the existing Dutch aFRR market, built on current rules and technical interfaces. | |

| Results: One access point to the Dutch intraday trading and aFRR markets. The interface acts as an add-on “switchboard” that enables an easy, harmonised (technical) connectivity to existing interfaces, each with their own formats and rules. | |

| Location: Switzerland | Year: 2022 (pilot project completed) |

|---|---|

| Description: Coordination between a TSO and DSOs regarding the use of distributed energy resources such as batteries, heat pumps and charging stations for power system services, in collaboration with EQUIGY. | |

| Design: Development of a coordination approach that enables the efficient utilisation of distributed energy resources for transmission and distribution grid services and brings the greatest benefit to the security of the overall electricity system. | |

| Results: Conceptualisation of a coordination mechanism accepted by both the Swiss TSO and a large Swiss DSO and aggregator. The concept is based on a so-called traffic light model and defines all required data exchanges among the TSOs, DSOs and aggregators. | |

| Location: Italy | Year: 2022 |

|---|---|

| Description: Facilitation of distributed resources in the ancillary services market, i.e. static reserve, frequency regulation, voltage regulation and grid re-powering, in collaboration with EQUIGY. | |

| Design: Flexibility assets capacity available to the electricity system through the EQUIGY blockchain-based platform, which aims to encourage the participation of new distributed resources in the dispatching services markets and to facilitate the work of Balancing Service Providers (BSPs). | |

| Results: Resource aggregators participating in the Virtually Aggregated Mixed Units (UVAM) project can use EQUIGY Crowd Balancing Platform to register and pre-qualify their flexibility resources for the supply of ancillary services to the electricity system. | |

| Location: Europe | Year: 2020 (pilot project completed) |

|---|---|

| Description: The EQUIGY platform [9] is an operational blockchain-based system which shares relevant information between the participating parties in a transaction – such as TSOs, DSOs, Aggregators, and data providers – in a trusted and secured manner. | |

| Design: The platform facilitates the standardised registration, bidding and activation of flexibility transactions from the aggregators of DERs. It enables the proof of delivery of flexibility transactions, while allowing the market to operate within grid limits. The platform makes offers to TSOs along with the following demands:

The following European TSOs have joined the EQUIGY Crowd Balancing Platform: Swissgrig, APG, Tennet (DE/NL), Terna. EU-funded projects are contributing to the development of similar platforms:

| |

| Results: Confirmation that the blockchain-based system can be used to deliver flexibility services. | |

| Location: Switzerland | Year: 2020 (pilot project completed) |

|---|---|

| Description: Focus on FCR, with small-scale flexible devices (e.g. electric vehicles, batteries, heating/cooling devices), collaboration with EQUIGY. | |

| Design: Test of real-time monitoring of reserve provision and ex-post validation of FCR delivery with the Crowd Balancing Platform (CBP), in cooperation with a Swiss electricity provider as the commercial and technical aggregator using a 1.2 MW battery. | |

| Results: Confirmation that CBP and its blockchain technology can be used as basis for all FCR-related business projects. | |

| Location: Netherlands | Year: 2020 |

|---|---|

| Description: Delivering aFRR with different types of flexible capacity, in cooperation with an electricity provider and the EQUIGY Platform. | |

| Design: TenneT and the electricity provider jointly ensure the supply of flexibility (in the form of aFFR or regulating capacity) to the electricity system. The EEMS (27MW) wind farm was connected as a first flexible asset in the project. EQUIGY facilitates the necessary data exchange by means of blockchain technology. | |

| Results: Enhancement of delivering aFRR with other types of flexible capacity in the Netherlands. | |

Technology Readiness Level The TRL has been assigned to reflect the European state of the art for TSOs, following the guidelines available here.

- TRL 9 for the EQUIGY platform.

- TRL 7 for the prototype results of several EU-funded projects (mentioned above).

References and further reading

D. Mee, “An Introduction to Interoperability in the Energy Sector,” 2018.

M. Robinius et al., “Linking the Power and Transport Sectors—Part 1: The Principle of Sector Coupling,” Energies, vol. 10, no. 7, p. 956, 2017.

N.Putkonen, “How the future energy system will benefit from sector integration,” VTT, 2023.

B. Reidenbach et al., “Towards net-zero: Interoperability of technologies to transform the energy system,” OECD Going Digital Toolkit Notes, No. 24, OECD Publishing, Paris, 2022.

R. Kuchenbuch et al., “D2.1 Interoperability Maturity Model Framework and Background” int:NET, 2023.

Regulation (EU) 2022/868 of the European Parliament and of the Council of 30 May 2022 on European Data Governance.

R. Kuchenbuch et al., “Quality properties of IEC 62559 use cases and SGAM models,” Energy Informatics, vol. 6, supplement 1, p. 38, 2023.

M. Wang et al., “Multi-vendor interoperability in HVDC grid protection: State-of-the-art and challenges ahead,” IET Generation, Transmission & Distribution, vol. 15, p. 2153, 2021.

J.M. Couto et al., “European

ENTSO-E, “ENTSO-E Research, Development, & Innovation Roadmap 2024-2034,”

MCCS, “Developing the new grid control system for a successful energy transition,”

ENTSO-E

ENTSO-E